When I first moved down to DC five years ago, I finished college with more than $85k in student loan debt. The year was 2010, and like many others that have graduated with student loan debt, I felt completely tied down. How could I afford to do anything else besides pay off my student loans?

I’m sure many of you have felt this way as well.

Spending my money on anything else besides debt reduction seemed frivolous, and to be frank, a completely dumb idea. Working at a job, paying down debt, and being a “responsible” adult seemed like the right thing to do. After all, I didn’t have a financial safety net to fall back on. So, did I end up letting the boat load of debt stop me from traveling?

Absolutely not.

It’s been five years since college graduation, and I’m happy to report that not only have I paid off nearly $60k of my student loans, but I’ve also been able to travel to more places than I had ever thought possible. In this post, I’ll share my number one tip on how I’ve been able to pay down my student loan debt while still traveling.

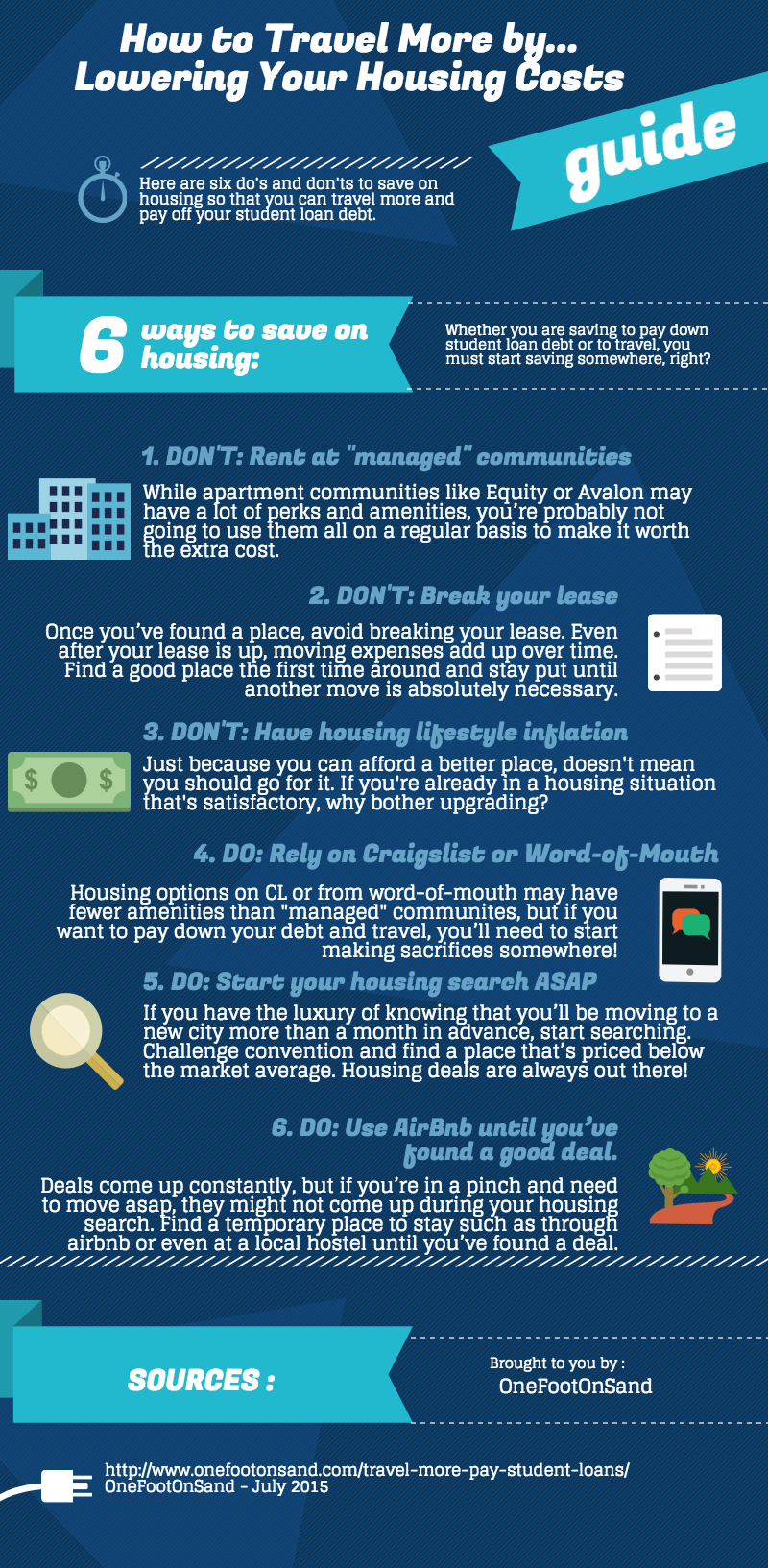

My #1 Tip: Keep housing and transportation costs as low as possible, for as long as possible.

I live in the Washington D.C. area, one of the most expensive places to live in the U.S. For perspective, expect to pay at least between $700 – $1,000 for a bedroom in a shared apartment, $1,300 for a studio, and at minimum $1,500 for a one-bedroom in a part of town that’s Metro accessible. I knew that if I was going to have any success at paying down my debt and having money for travel, I needed to cut back as much as possible on housing and transportation.

Back in 2010, I was surprised to learn that $1,200 was a GOOD price for a studio. I completely avoided looking for apartments at managed properties like Avalon or Equity, and figured I could find a deal if I stuck with Craigslist. Sure enough, after weeks of checking, I found a great studio, within walking distance to my job and the Metro station for only $1,000/rent.

I lived in this apartment for about a year, after which I moved into a two-bedroom apartment with some friends a few metro stops away. At first, I opted to share a room with one of my friends, but after my friend moved out, I had the option of taking over the whole room and paying $900/month for it, or looking for a new roommate to keep my costs down. Realizing this decision could impact my ability to travel and continue paying down my student debt, I ended up going with the latter. I moved into our apartment’s living room, and had a new roommate pick up the cost of the extra bedroom. Although I gave up my privacy, by opting for a new roommate I was able to decrease my rent substantially, paying $300/month.

Two and half years later when my roommate left DC, I again had the option of taking over the room and paying $900/month or finding another roommate and continuing to live in the living room. With my 27th birthday just around the corner, I figured it was about time I had a space of my own, and opted to take over the room.

I thought it was going to be worth it to have a space of my own. I was finally a grown-up. But then I realized something: my extra income that went to travel and debt reduction was no more. What did I value more: my privacy or the freedom to have extra money to do other things?

Obviously, freedom won out.

I’m back living in the living room, but was able to negotiate my rent down to $200/month. Yes, you read that right, I’m spending just $200/month to live in one of the most expensive places in the country. Even though I can afford to move out, and have been told by my family and friends that I’m crazy to still live the way I do at my age, I have no intention of leaving my housing situation anytime soon. For me, my cheap rent IS my safety net. It’s what enables me to pay down my student loans and travel at the same time, and that’s something that I know I definitely don’t want to give up.

What sacrifices do you make to travel more, while still keeping up with your own “responsibilities?”

Check out my guide on how to travel more by spending less on housing!